The Opportunity Business Intelligence Solution Automates and Calculates Agent Commission Payments

Fiserv is a leading provider of financial services technology, catering to a diverse clientele that includes banks, credit unions, finance companies, and retailers. Its product portfolio encompasses a range of payment processing solutions, such as card issuers, network services, e-commerce, mobile banking, and payment acceptance platforms on the merchant acquiring side.

Fiserv's finance department calculates monthly ISO agent commissions based on transaction types, payment methods, and merchant service/product use aligned with specific pricing agreements. They handle five commission payments monthly across various portfolios, with one involving complex agent structures, withdrawals, advances, and splits for team deals.

These reports and processes demand extensive manual efforts. They wish to have an automated payroll application that streamlines operations, integrating journal entries, commission calculations, and business intelligence to enable the finance team to efficiently generate income and expense reports categorized by transaction source and product.

Our Response A Unified System for Transaction Data Monitoring and Enhanced Financial Reporting

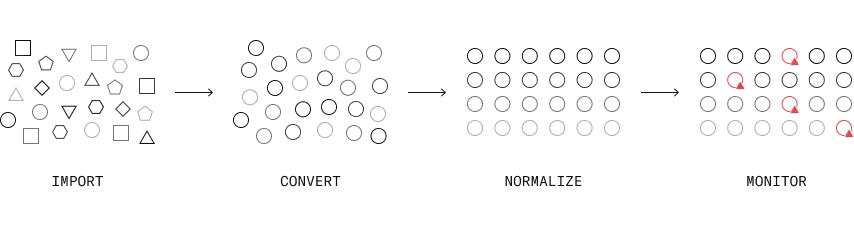

The commission structure varies significantly across different agent portfolios. Some pricing agreements with agents were established directly by Fiserv, while others were inherited from business portfolios acquired by the company. The primary goal was to import source files and create a unified data representation aligned with their internal model to accommodate the different data sets.

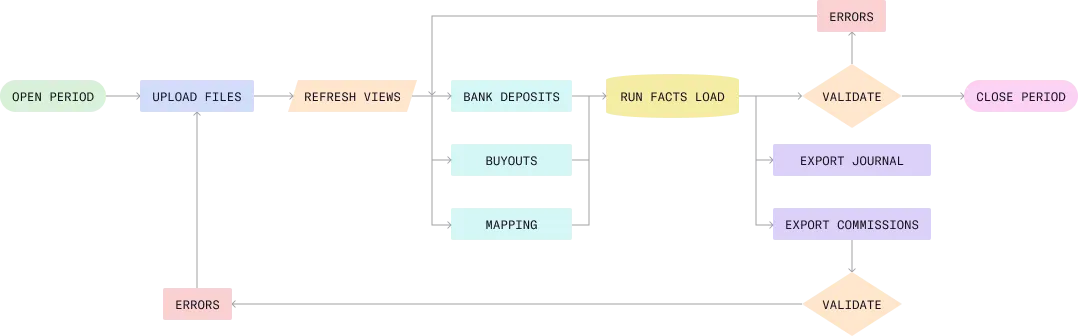

MojoTech’s approach was to ensure seamless importation of raw source files from the cloud, accompanied by a detailed history log for comprehensive tracking. This was followed by the meticulous conversion of raw data into a unified structured format that integrates with the finance department's data model, ensuring consistency and reliability.

Maintaining a historical record was essential to the system, as it captures and preserves the evolution of data at every stage. It actively monitors and logs any discrepancies or errors encountered during the import process, thus guaranteeing the integrity of complex financial reports.

Once the necessary infrastructure for data import and normalization was in place and data accuracy confirmed, a web application equipped with an intuitive user interface provided enhanced flexibility in generating various data views and efficiently managing issues related to the import process.

The Results A Drastic Reduction in Manual Labor Saves Countless Hours Required for Computing Income and Expenses

MojoTech developed a robust, scalable, and user-friendly business intelligence tool that consolidates reports from 12 to 15 different payment gateways into a unified dataset. It enables Fiserv to accurately calculate commissions for external agents and have deeper insights into revenue and cost drivers.

The payments reporting application features customizable reporting tools, which allow data to be grouped by source, portfolio, or product and enable the finance team to add, manage, and support new portfolio acquisitions efficiently and effectively. Furthermore, It allows Fiserv to view and rectify any data irregularities and creates a scalable system for future automation and advanced features.